Company | Investor Relations

Governance

OUR APPROACH TO CORPORATE GOVERNANCE

We believe that Visium’s long-term interests are best served when the company proactively considers and addresses the interests and concerns of stockholders and other stakeholders. To that end, we engage in honest and open communication about our company’s financial and governance activities and have made our Visium Code of Conduct, and the composition of our corporate committees publicly available on our website.

Our Board of Directors is charged with representing the interests of our stockholders and ensuring that the company is managed in alignment with our commitment to the principles of corporate responsibility.

We continually work to strengthen our performance. Below are a few highlights of our corporate governance practices:

The compensation committee of the Board of Directors undertakes a rigorous review of proposed executive compensation packages to ensure a balance between fair compensation and Visium’s ability to attract and retain top talent. The process includes a comprehensive performance evaluation, comparison with other companies’ practices, and consultation with compensation experts.

We review our internal controls and strengthen our policies and procedures to ensure that our accounting systems are accurate and reliable.

Leadership

Visium’s leaders bring decades of diverse experience and a history of success.

VISIUM TECHNOLOGIES, INC.

CODE OF BUSINESS CONDUCT & ETHICS

You will find attached here to our Code of Business Conduct and Ethics (the “Code”). Our Code is a reaffirmation of our commitment to conducting our business ethically and to observing applicable laws, rules and regulations. Moreover, the reputation and continued success of Visium Technologies, Inc. (the “Company”) depends on the conduct of its employees and directors. Each employee and director, as a custodian of the Company’s good name, has a personal responsibility to ensure that his or her conduct protects and promotes both the letter of the Code and its spirit of ethical conduct. Your adherence to these ethical principles is fundamental to our future success.

The Code cannot provide definitive answers to all questions. Accordingly, we expect each employee and director to exercise reasonable judgment to determine whether a course of action is consistent with our ethical standards and to seek guidance when appropriate. Your supervisor will often be the person who can provide you with thoughtful, practical guidance in your day-to-day duties. We have also appointed Mark B. Lucky, our Chief Financial Officer, as our Ethics Compliance Officer, so you should feel free to ask questions or seek guidance from him.

Please read the Code carefully. If you have any questions concerning the Code, please speak with your supervisor or the Ethics Compliance Officer. You may also be asked periodically in succeeding years to confirm in writing that you have complied with the Code.

VISIUM TECHNOLOGIES, INC.

CODE OF BUSINESS CONDUCT & ETHICS

I. INTRODUCTION

PURPOSE AND SCOPE

The Board of Directors of Visium Technologies, Inc. (the “Company”) adopted this Code of Business Conduct and Ethics (this “Code”) to aid the Company’s directors, officers and employees in making ethical and legal decisions when conducting the Company’s business and performing their day-to-day duties.

The Company’s Board of Directors (the “Board”), in conjunction with its Audit Committee, is responsible for administering the Code. The Board has delegated day-to-day responsibility for administering and interpreting the Code to an Ethics Compliance Officer. Mark B. Lucky, our Chief Executive Officer, has been appointed the Company’s Ethics Compliance Officer (the “Ethics Compliance Officer”) under this Code.

The Company expects its directors, officers and employees to exercise reasonable judgment when conducting the Company’s business. The Company encourages its directors, officers and employees to refer to this Code frequently to ensure that they are acting within both the letter and the spirit of this Code. If you have questions or concerns about this Code, the Company encourages you to speak with your supervisor (if applicable) or with the Ethics Compliance Officer under this Code.

CONTENTS OF THIS CODE

This Code has two sections that follow this Introduction. The first section, “Standards of Conduct,” contains the actual guidelines that our directors, officers and employees are expected to adhere to in the conduct of the Company’s business. The second section, “Compliance Procedures,” contains specific information about how the Code functions, including who administers the Code, who can provide guidance under the Code and how violations may be reported, investigated and disciplined. This second section also contains a discussion about waivers of and amendments to this Code.

A NOTE REGARDING OTHER OBLIGATIONS

The Company’s directors, officers and employees generally have other legal and contractual obligations to the Company. This Code is not intended to reduce or limit the other obligations that you may have to the Company. Instead, the standards in this Code should be viewed as the minimum standards that the Company expects from its directors, officers and employees in the conduct of its business.

II. STANDARDS OF CONDUCT

OVERVIEW

The Company understands that this Code will not contain the answer to every situation you may encounter or every concern you may have about conducting the Company’s business ethically and legally; however, a good rule to follow is to consider whether you would feel comfortable if your potential actions or dealings were made public – if the answer is no, you should reconsider following through on them.

CONFLICTS OF INTEREST

The Company recognizes and respects the right of its directors, officers and employees to engage in outside activities that they may deem proper and desirable, provided that these activities do not impair or interfere with the performance of their duties to the Company or their ability to act in the Company’s best interests. In most, if not all, cases this will mean that our directors, officers and employees must avoid situations that present a potential or actual conflict between their personal interests and the Company’s interests.

A “conflict of interest” occurs when a director’s, officer’s or employee’s personal interest interferes with the Company’s interests. Conflicts of interest may arise in many situations. For example, conflicts of interest can arise when a director, officer or employee takes an action or has an outside interest, responsibility or obligation that may make it difficult for him or her to perform the responsibilities of his or her position objectively and/or effectively in the Company’s best interests. Conflicts of interest may also occur when a director, officer or employee or his or her immediate family member receives some personal benefit as a result of the director’s, officer’s or employee’s position with the Company. Each individual’s situation is different and in evaluating his or her own situation, a director, officer or employee will have to consider many factors.

Any material transaction or relationship that reasonably could be expected to give rise to a conflict of interest should be reported promptly to the Ethics Compliance Officer. The Ethics Compliance Officer may notify the Board or its Audit Committee as he or she deems appropriate. Actual or potential conflicts of interest involving a director or executive officer other than the Ethics Compliance Officer should be disclosed directly to the Ethics Compliance Officer. Actual or potential conflicts of interest involving the Ethics Compliance Officer should be disclosed directly to the Chairman of the Audit Committee.

COMPLIANCE WITH LAWS, RULES AND REGULATIONS

The Company seeks to conduct its business in compliance with applicable laws, rules and regulations. No director, officer or employee shall engage in any unlawful activity in conducting the Company’s business or in performing his or her day-to-day company duties, nor should he or she instruct others to do so.

PROTECTION AND PROPER USE OF THE COMPANY’S ASSETS

The Company’s assets include its intellectual property rights, company equipment, physical servers and communication facilities. Loss, theft and misuse of the Company’s assets have a direct impact on the Company’s business and its profitability. Directors, officers and employees are expected to protect the Company’s assets that are entrusted to them and to protect the Company’s assets in general. Directors, officers and employees are also expected to take steps to ensure that the Company’s assets are used only for legitimate business purposes.

CORPORATE OPPORTUNITIES

Directors, officers and employees owe a duty to the Company to advance its legitimate business interests when the opportunity to do so arises. Each director, officer and employee is prohibited from:

diverting to himself or herself or to others any opportunities that are discovered through the use of the Company’s property or information, or as a result of his or her position with the Company, unless such opportunity has first been presented to, and rejected in writing by, the Ethics Compliance Officer of the Company;

using the Company’s property or information or his or her position for improper personal gain; or

competing with theCompany.

CONFIDENTIALITY

Confidential Information generated and gathered in the Company’s business plays a vital role in its business, prospects and ability to compete. “Confidential Information” includes all non-public information that might be of use to competitors or harmful to the Company or its customers if disclosed. Directors, officers and employees may not disclose or distribute the Company’s Confidential Information, except when disclosure is authorized by the Company or required by applicable law, rule or regulation or pursuant to an applicable legal proceeding. Directors, officers and employees shall use Confidential Information solely for legitimate company purposes. Directors, officers and employees must return all of the Company’s Confidential Information and proprietary information in their respective possession to the Company when they cease to be employed by or to otherwise serve the Company.

FAIR DEALING

Competing vigorously, yet lawfully, with competitors and establishing advantageous, but fair, business relationships with customers and suppliers is a part of the foundation for long-term success. However, unlawful and unethical conduct, which may lead to short-term gains, may damage a company’s reputation and long-term business prospects. Accordingly, it is the Company’s policy that directors, officers and employees must deal ethically and lawfully with the Company’s collaborators, customers, suppliers, competitors and employees in all business dealings on the Company’s behalf. No director, officer or employee should take unfair advantage of another person in business dealings on the Company’s behalf through the abuse of privileged or confidential information or through improper manipulation, concealment or misrepresentation of material facts.Accuracy of Records

The integrity, reliability and accuracy in all material respects of the Company’s books, records and financial statements are fundamental to the Company’s continued and future business success. No director, officer or employee may cause the Company to enter into a transaction with the intent to document or record it in a deceptive or unlawful manner. In addition, no director, officer or employee may create any false or artificial documentation or book entry for any transaction entered into by the Company. Similarly, officers and employees who have responsibility for accounting and financial reporting matters have a responsibility to accurately record all funds, assets and transactions on the Company’s books and records.

TRADING IN THE SECURITIES OF OTHER COMPANIES

No director, officer or employee of the Company who, in the course of working for the Company, learns of any material, nonpublic information about a company with which the Company does business (e.g., a customer, supplier or other party with which the Company is negotiating a major transaction, such as an acquisition, investment or sale), may trade in that company’s securities until the information becomes public or is no longer material. This remains true even in the event that you are no longer working with or for the Company.

POLITICAL CONTRIBUTIONS/GIFTS

Business contributions to political campaigns are strictly regulated by federal, state, provincial and local law in the U.S., Canada and other jurisdictions. Accordingly, all political contributions proposed to be made with the Company’s funds must be coordinated through and approved by the Ethics Compliance Officer. Directors, officers and employees may not, without the approval of the Ethics Compliance Officer, use any of the Company’s funds for political contributions of any kind to any political candidate or holder of any national, state, provincial or local government office. Directors, officers and employees may make personal contributions, but should not represent that he or she is making any such contribution on the Company’s behalf. Similar restrictions on political contributions may apply in other countries. Specific questions should be directed to the Ethics Compliance Officer.

ENTERTAINING OR DOING BUSINESS WITH THE UNITED STATES AND FOREIGN GOVERNMENTS

Giving anything of value to a government employee is strictly regulated and in many cases prohibited by law. The Company and its directors, officers and employees must also comply with federal, state, provincial and local laws in the U.S. and Canada, including the Foreign Corrupt Practices Act, as well as other foreign government laws, governing the acceptance of business courtesies. The Company and its directors, officers and employees acting on the Company’s behalf are prohibited from offering, promising, paying or authorizing the payment, directly or indirectly, to a government official to influence or reward any act of such official. Directors, officers and employees should consult with the Ethics Compliance Officer before providing or paying for any meals, refreshments, travel or lodging expenses, or giving anything of value to any federal, state, provincial or local U.S. or Canadian government employees, or to government employees of other countries.

QUALITY OF PUBLIC DISCLOSURES

The Company is committed to providing its stockholders with information about its financial condition and results of operations as required by the securities laws of the United States. It is the Company’s policy that the reports and documents it files with or submits to the Securities and Exchange Commission include fair, timely and understandable disclosure. Officers and employees who are responsible for these filings and disclosures, including the Company’s principal executive, financial and accounting officers, must use reasonable judgment and perform their responsibilities honestly, ethically and objectively in order to ensure that this disclosure policy is fulfilled. Members of the Company’s Disclosure Committee are primarily responsible for monitoring the Company’s public disclosure.

INTERNATIONAL TRADE CONTROLS

Many countries regulate international trade transactions, such as imports, exports and international financial transactions. In addition, the United States prohibits any cooperation with boycotts against countries friendly to the United States or against firms that may be “blacklisted” by certain groups or countries. It is the Company’s policy to comply with these laws and regulations even if it may result in the loss of some business opportunities. Employees should learn and understand the extent to which U.S. and international trade controls apply to transactions conducted by the Company.

PROMOTING A POSITIVE WORK ENVIRONMENT

The Company is committed to creating a supportive work environment and each employee is expected to create a respectful workplace culture that is free of harassment, intimidation, bias and unlawful discrimination. The Company is an equal opportunity employer and employment is based solely on individual merit and qualifications directly related to professional competence. The Company strictly prohibits discrimination or harassment of any kind on the basis of race, color, religion, veteran status, national origin, ancestry, pregnancy status, sex, gender identity or expression, age, marital status, mental or physical disability, medical condition, sexual orientation or any other characteristics protected by law.

COMPLIANCE WITH FOREIGN CORRUPT PRACTICES ACT

The U.S. Foreign Corrupt Practices Act (the “FCPA”) prohibits giving anything of value, directly or indirectly, to officials of a foreign government or to foreign political candidates in order to obtain or to retain business, induce the foreign official to perform or omit any act in violation of his public duty, influence the foreign official to affect or influence any government action, or obtain any other business advantage.

Directors, officers and employees are strictly prohibited from making any payments or providing anything of value on behalf of the Company in violation of the FCPA. State and local governments, as well as foreign governments, may have additional rules regarding such payments. Directors, officers and employees shall comply with the FCPA and all other applicable anti- bribery, anti-kickback, and anti-corruption laws, rules, and regulations.

The Company’s policies and procedures regarding compliance with the FCPA are memorialized in the Company Foreign Corrupt Practices Act Policy (“FCPA Policy”). Directors, officers and employees have a continuing and independent obligation to ensure compliance with the FCPA and the FCPA Policy.

III. COMPLIANCE PROCEDURES

COMMUNICATION OF CODE

All directors, officers and employees will be supplied with a copy of the Code upon the later of the adoption of the Code and beginning service at the Company. Updates of the Code will be provided from time to time. A copy of the Code is also available to all directors, officers and employees by requesting one from the Company or by accessing the Company’s website at www.VisiumTechnologies.com.

MONITORING COMPLIANCE AND DISCIPLINARY ACTION

The Company’s management, under the supervision of its Board or its Audit Committee, shall take reasonable steps from time to time to (i) monitor compliance with the Code, and (ii) when appropriate, impose and enforce appropriate disciplinary measures for violations of the Code.

Disciplinary measures for violations of the Code may include, but are not limited to, counseling, oral or written reprimands, warnings, probation or suspension with or without pay, demotions, reductions in salary, termination of employment or service and restitution.

The Company’s management shall periodically report to the Board or the Audit Committee, as applicable, on these compliance efforts including, without limitation, periodic reporting of alleged violations of the Code and the actions taken with respect to any such violation.

REPORTING CONCERNS/RECEIVING ADVICE

COMMUNICATION CHANNELS

Be Proactive. Every employee is encouraged to act proactively by asking questions, seeking guidance and reporting suspected violations of the Code and other policies and procedures of the Company, as well as any violation or suspected violation of applicable law, rule or regulation arising in the conduct of the Company’s business or occurring on the Company’s property. If any employee believes that actions have taken place, may be taking place, or may be about to take place that violate or would violate the Code or any law, rule or regulation applicable to the Company, he or she is obligated to bring the matter to the attention of the Company.

Seeking Guidance. The best starting point for an officer or employee seeking advice on ethics-related issues or reporting potential violations of the Code will usually be his or her supervisor. However, if the conduct in question involves his or her supervisor, if the employee has reported the conduct in question to his or her supervisor and does not believe that he or she has dealt with it properly, or if the officer or employee does not feel that he or she can discuss the matter with his or her supervisor, the employee may raise the matter with the Ethics Compliance Officer.

Communication Alternatives. Any officer or employee may communicate with the Ethics Compliance Officer, or report potential violations of the Code, by any of the following methods:

By e-mail to mlucky@visiumtechnologies.com (anonymity cannot be maintained); or

In writing (which may be done anonymously as set forth below under “Anonymity”), addressed to the Ethics Compliance Officer, by U.S. mail to c/o Visium Technologies, Inc., Visium Technologies, Inc., PO Box 383, Oakton VA 22124.

Reporting Accounting and Similar Concerns. Any concerns or questions regarding any potential violations of the Code, any company policy or procedure or applicable law, rules or regulations that involves accounting, internal accounting controls, auditing or securities law matters will be directed to the Audit Committee or a designee of the Audit Committee in accordance with the procedures established by the Audit Committee for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters. Officers and employees may also communicate directly with the Audit Committee or its designee regarding such matters by the following methods (which may be done anonymously as set forth below under “Anonymity”):

By e-mail to mlucky@visiumtechnologies.com (anonymity cannot be maintained); or

In writing (which may be done anonymously as set forth below under “Anonymity”), addressed to the Ethics Compliance Officer, by U.S. mail to c/o Visium Technologies, Inc., Visium Technologies, Inc., PO Box 383, Oakton VA 22124.

Cooperation. Employees are expected to cooperate with the Company in any investigation of a potential violation of the Code, any other company policy or procedure, or any applicable law, rule or regulation.

Misuse of Reporting Channels. Employees must not use these reporting channels in bad faith or in a false or frivolous manner or to report grievances that do not involve the Code or other ethics-related issues.

Director Communications. In addition to the foregoing methods, a director may also communicate concerns or seek advice with respect to this Code by contacting the Board through its Chairman or the Audit Committee.

ANONYMITY

When reporting suspected violations of the Code, the Company prefers that officers and employees identify themselves to facilitate the Company’s ability to take appropriate steps to address the report, including conducting any appropriate investigation. However, the Company also recognizes that some people may feel more comfortable reporting a suspected violation anonymously.

If an officer or employee wishes to remain anonymous, he or she may do so, and the Company will use reasonable efforts to protect the confidentiality of the reporting person subject to applicable law, rule or regulation or to any applicable legal proceedings. In the event the report is made anonymously, however, the Company may not have sufficient information to look into or otherwise investigate or evaluate the allegations. Accordingly, persons who make reports anonymously should provide as much detail as is reasonably necessary to permit the Company to evaluate the matter(s) set forth in the anonymous report and, if appropriate, commence and conduct an appropriate investigation.

NO RETALIATION

The Company expressly forbids any retaliation against any officer or employee who, acting in good faith on the basis of a reasonable belief, reports suspected misconduct. Specifically, the Company will not discharge, demote, suspend, threaten, harass or in any other manner discriminate against, such an officer or employee in the terms and conditions of his or her employment. Any person who participates in any such retaliation is subject to disciplinary action, including termination.

WAIVERS AND AMENDMENTS

No waiver of any provisions of the Code for the benefit of a director or an executive officer (which includes without limitation, for purposes of this Code, the Company’s principal executive, financial and accounting officers) shall be effective unless (i) approved by the Board or, if permitted, the Audit Committee, and (ii) if applicable, such waiver is promptly disclosed to the Company’s stockholders in accordance with applicable U.S. securities laws and/or the rules and regulations of the exchange or system on which the Company’s shares are traded or quoted, as the case may be.

Any waivers of the Code for other employees may be made by the Ethics Compliance Officer, the Board or, if permitted, the Audit Committee.

All amendments to the Code must be approved by the Board or the Audit Committee and, if applicable, must be promptly disclosed to the Company’s shareholders in accordance with applicable United States securities laws and NASDAQ rules and regulations.

ADOPTED: 5 June 2018

EFFECTIVE: 21 July 2018

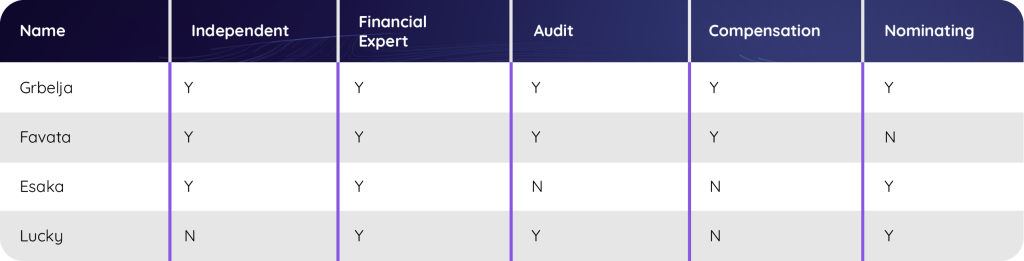

CORPORATE COMMITTEES

Below is the structure of our Board Committees: