To Visium Technologies shareholders and interested investors:

We often receive questions from interested parties at info@visiumtechnologies.com, and therefore are providing this first in a series of answers to Frequently Asked Questions (FAQ’s).

Frequently Asked Questions

What’s the status on sales?

Visium is a relatively new player in the cybersecurity space and TruContext™ is a new technology solution. That, coupled with the fact that an enterprise level sale is typically a complicated and lengthy process, our sales have come more slowly than anticipated. Additionally, it should be noted that the federal government sales cycle is long and federal sales has been our initial focus.

Breaking into the commercial enterprise market has also taken longer than anticipated, largely because these enterprise customers typically have established cyber security operations. What we have experienced is that even though these potential customers understand the value proposition and benefits of TruContext™, they have been slow to add any new technologies to their ecosystem. An additional factor in some cases has been because we are viewed as a small company and perceived as being underfunded. We have seen customers love the technology and recognize the value of TruContext™ but hesitate to do business with us because of our size and balance sheet. These challenges are being addressed.

The first sale is always the hardest. Our sales pipeline is growing and there are many significant (multi-year and significant size) opportunities that we are focused on. Investors should know that our technology has been well-received and is highly regarded – the company is in advanced negotiations with a number of potential partners and end user customers.

Can you please explain Visium’s strategy of partnering with other tech companies versus competing with them?

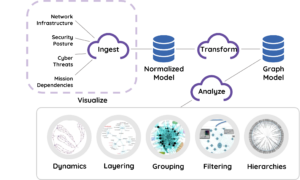

TruContext™ is our proprietary technology platform which was originally developed by the US Army for cyber security. Our proprietary upgrades to this technology have added tremendous flexibility to the platform so that we can ingest any data from any source and from any system in real time – to provide enhanced analytics and visualization capabilities. This ability is unique to TruContext™ and is not offered with any other cybersecurity solution.

The result is that we can apply analytics in any big data scenario – whether in cyber security, security camera and public safety networks, anti-fraud, critical infrastructure etc. As it relates to cybersecurity, we can take data from any existing cyber tool such as Splunk, Tenable, Datadog, or Crowdstrike, for example, and provide additional context and value to those datasets through our proprietary analytics. We don’t look to displace these other technologies; rather we make them more useful and meaningful and easier to use for the security analyst. And this enhancement is demonstrable and can be validated to potential customers.

Another great example of the flexibility of the TruContext™ platform is how it’s being used with our video “searchveillance” (search and surveillance) technology partner IREX (https://irex.ai/). We are able to ingest video and the related metadata and enrich the artificial intelligence solution that IREX provides taking their technology to a whole different level. We see IREX as becoming a significant partner as we move forward.

Why reverse split the stock?

Simple…to uplist, and to raise the capital to sufficiently fund our strategy for growth, which we believe will dramatically enhance shareholder value as we execute our business plan. We believe that those aforementioned partners and potential customers that are currently standing by until we are funded will engage with us once our balance sheet and investment profile satisfies the risk managers at these companies.

Uplisting to the NASDAQ is very important for several reasons. We have seen first-hand that the sub-penny pink sheets is a very difficult market to receive a fair valuation from investors. We also know that we are being followed by many microcap investors that will serve us well when we uplist. In addition, we strongly believe that the capital that we raise as part of our uplist will allow us to close many sales opportunities with customers who have been reluctant to engage with us due to being a pink sheet company with limited resources. Look for revenue to come from many of these customers once we uplist.

Our team is working with a communications firm that is helping us implement fresh strategies to engage with a broader investor demographic. You will be seeing more social media activity about Visium across many more platforms going forward in addition to our participation at upcoming investment conferences.

Stay tuned for more FAQ communications as we move forward.

We would like to ask investors who have received this e-mail to encourage any colleagues who are NOT on this Company Update list to sign up at info@visiumtechnologies.com for continuing communications.

Safe Harbor Statement: Under the Private Securities Litigation Reform Act of 1995: This e-mail communication includes forward-looking statements that reflect management’s current views with respect to future events and performance. These forward-looking statements are based on management’s beliefs and assumptions and information currently available. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project” and similar expressions that do not relate solely to historical matters identify forward-looking statements. Investors should be cautious in relying on forward-looking statements because they are subject to a variety of risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed in any such forward-looking statements. These factors include, but are not limited to, whether the reverse stock split will be beneficial to the Company and its shareholders, any inability to meet the NYSE American continued listing standards in the future for any reason, and those other factors described in our filings with the U.S. Securities and Exchange Commission. Any responsibility to update forward-looking statements is expressly disclaimed.